Understanding What Medicare Actually Covers For Home Health

Medicare's coverage of home health care can be confusing. While it can cover certain home health services, it's not a blanket guarantee. Specific requirements must be met to qualify for these benefits. Understanding these criteria is essential for accessing the care you need.

Key Criteria for Medicare Home Health Coverage

Four key elements determine your eligibility for Medicare home health benefits.

-

Homebound Status: You must be considered homebound. This means leaving home isn't recommended because of your condition. Leaving requires a considerable and taxing effort. Occasional outings for medical appointments, religious services, or short, essential errands are permissible.

-

Skilled Care Requirement: A doctor must certify that you need skilled care. This includes services like skilled nursing, physical therapy, or speech-language pathology. These services must be provided by trained medical professionals.

-

Medical Necessity: The skilled care must be medically necessary to treat an illness or injury. This means the services are crucial for your recovery and overall health management.

-

Medicare-Certified Agency: The services must be delivered by a Medicare-certified home health agency. Using an unapproved provider may result in denied claims.

Skilled Care vs. Unskilled Care

Medicare makes a crucial distinction between skilled care and unskilled care. Skilled care, as mentioned above, involves services requiring medical professionals. Examples include wound care, medication management, and patient education. Unskilled care includes help with daily tasks like bathing, dressing, or meal preparation. Medicare generally doesn't cover unskilled care, even if you require assistance. This distinction is often a point of confusion for families. You might be interested in: 6 Reasons Home Health Care Is Essential.

The Role of Your Physician

Your physician plays a vital role in obtaining Medicare home health coverage. They must certify your need for skilled care by creating a home health plan of care. This plan outlines the specific services you require, their frequency, and the expected duration. The physician’s certification and detailed plan are crucial for Medicare approval. Maintaining open communication with your doctor is essential throughout this process.

Medicare's home health program helps millions of people. According to CMS Program Statistics, Medicare covers over 11,000 home health agencies and serves more than 3 million beneficiaries annually. Aggregate spending reaches billions of dollars each year. Policy updates, like the 2020 Patient-Driven Groupings Model (PDGM), focus agency reimbursement on patient-centric care. Understanding Medicare's requirements helps you access the home health care you need.

Breaking Down Covered Services And What You'll Actually Get

Understanding Medicare coverage for home health care involves more than just a simple yes or no. Knowing which services are covered is crucial for both planning your care and managing your expectations. Skilled care and non-skilled care are distinct categories under Medicare, and this distinction significantly impacts your coverage.

Skilled Home Health Care Services Covered by Medicare

Medicare generally covers skilled care services deemed medically necessary and prescribed by a physician. These services must be delivered by a Medicare-certified home health agency. Here are some examples:

-

Skilled Nursing Care: This includes services like wound care, medication administration, vital sign monitoring, and chronic condition management. These require the expertise of a registered nurse or a licensed practical nurse.

-

Physical Therapy: Physical therapy aims to restore movement, strength, and function after illness or injury. It often involves exercises, stretches, and other therapeutic interventions.

-

Speech-Language Pathology: This service addresses speech, language, and swallowing disorders. Therapists work with patients on communication skills, cognitive function, and safe eating practices.

-

Occupational Therapy: Occupational therapy focuses on improving a patient's ability to perform daily tasks, such as bathing, dressing, and eating. It aims to increase independence and enhance quality of life.

-

Medical Social Services: Social workers provide counseling and support to patients and their families, helping them navigate the emotional and social challenges of illness. They also connect patients with community resources.

Services Typically Not Covered

While Medicare's home health benefit provides valuable assistance, it doesn't cover everything. This is often a source of confusion. Typically excluded services include:

-

24-Hour Home Care: Medicare doesn't cover around-the-clock home care. Services are provided intermittently, not continuously.

-

Meal Delivery: While meal preparation might be covered under specific medical circumstances, general meal delivery services are not included.

-

Homemaker Services: General housekeeping tasks like cleaning, laundry, and shopping aren't considered medically necessary and are therefore not covered.

-

Personal Care: Help with bathing, dressing, and toileting—often called custodial care or personal care—is generally excluded unless provided in conjunction with skilled care.

Understanding Coverage Requirements and Limitations

Each covered service has specific requirements and limitations regarding frequency, duration, and medical necessity. To illustrate, physical therapy might be approved for a set number of sessions per week for a limited time, depending on individual patient needs and progress.

To help clarify what is and isn't covered, let's look at a detailed breakdown:

Medicare Covered Home Health Services Breakdown

Comprehensive comparison of covered vs. non-covered home health services under Medicare

| Service Type | Medicare Coverage | Requirements | Limitations |

|---|---|---|---|

| Skilled Nursing Care | Yes | Medically necessary, physician ordered, provided by certified agency | Intermittent, not 24/7 |

| Physical Therapy | Yes | Medically necessary, physician ordered, provided by certified agency | Limited duration and frequency based on individual needs |

| Speech-Language Pathology | Yes | Medically necessary, physician ordered, provided by certified agency | Limited duration and frequency based on individual needs |

| Occupational Therapy | Yes | Medically necessary, physician ordered, provided by certified agency | Limited duration and frequency based on individual needs |

| Medical Social Services | Yes | Medically necessary, physician ordered, provided by certified agency | Limited duration and frequency based on individual needs |

| 24-Hour Home Care | No | N/A | N/A |

| Meal Delivery | Generally No | Specific medical circumstances may apply | N/A |

| Homemaker Services | No | N/A | N/A |

| Personal Care (Custodial Care) | Generally No | Unless provided with skilled care | N/A |

This table summarizes the key differences in coverage, highlighting what Medicare typically covers and what it typically excludes. Remember, individual circumstances can vary.

While Medicare may cover home health care, the extent of that coverage depends on a thorough assessment and a detailed plan of care. Learn more in our article about Home Health Wound Care Patient Outcomes. Understanding these nuances will help you maximize your benefits and manage expectations regarding Medicare coverage.

How Recent Payment Changes Are Affecting Your Care Options

Medicare's home health care benefit, while valuable, can be tricky to navigate. The payment system is complex and constantly changing, directly affecting your access to care. In many communities, families are finding it harder to find available home health providers due to recent payment adjustments. This means that qualifying for Medicare home health care doesn't guarantee you'll easily find services.

Understanding the Financial Pressures on Home Health Agencies

Home health agencies often operate with tight budgets. Changes in Medicare reimbursement rates have a major impact on their ability to offer services. For example, the Centers for Medicare & Medicaid Services (CMS) estimates a 0.5% increase, or $85 million, in Medicare payments to home health agencies (HHAs) for Calendar Year (CY) 2025 compared to CY 2024. This small increase combines a 2.7% payment update with various decreases due to behavioral adjustments and recalculations. The result is a net positive but only a slight gain for providers. Find more detailed statistics here. These financial pressures force agencies to make difficult choices, often leading to reduced service availability, staff cuts, or even closures.

The Impact on Service Availability and Access

These financial challenges have real consequences for those seeking care. Some agencies are limiting their service area, prioritizing patients who need less intensive care, or creating waiting lists. You might be interested in reading more about effective at-home wound care in this article: Effective Post-Discharge Wound Care at Home. This limited access impacts individuals and families relying on these services for essential medical support at home. It also puts more strain on family caregivers.

Navigating the Changing Home Health Landscape

Understanding these trends is crucial for securing the care you or your loved one needs. Proactive planning and open communication with your healthcare team are essential. Start the process of finding a home health agency early. Consider exploring alternative care options like telehealth or respite care. Being proactive helps navigate these challenges and ensures you receive the care you need, even within the evolving Medicare home health landscape. Preparation is key to addressing potential access issues.

What You'll Actually Pay For Medicare Home Health Services

Medicare covers home health care under certain conditions. However, it's essential to understand your financial obligations. Knowing potential out-of-pocket costs will help with budgeting and planning for your care.

Understanding Medicare's Cost-Sharing Structure for Home Health

For home health services approved by Medicare and provided by a certified agency, you generally pay nothing for the services themselves. This means you won't have a copayment or deductible for skilled nursing, physical therapy, speech therapy, or other covered services.

However, Durable Medical Equipment (DME), such as wheelchairs and hospital beds, has a different payment structure. Typically, you're responsible for 20% of the Medicare-approved amount for DME. For further information on home health care, you might find our guide on Pressure Ulcer Treatment Home Care helpful.

The 20% Coinsurance for Durable Medical Equipment

The 20% coinsurance for DME can become a considerable expense, particularly for long-term equipment needs. For instance, if a hospital bed costs $1,000 and Medicare approves it, you would owe $200. Being aware of this cost-sharing is crucial for budgeting.

Medicare Supplement Insurance (Medigap)

Medicare Supplement Insurance, commonly called Medigap, can offset some of these out-of-pocket costs. Various Medigap policies offer different coverage levels. Some plans might cover the 20% DME coinsurance, which can significantly lower your financial burden.

Non-Medicare-Certified Providers: Understanding the Risks

Using a home health provider not certified by Medicare can lead to significant financial risks. Medicare might not cover any of the costs, leaving you entirely responsible for payment. Always verify a provider's Medicare certification before starting services.

Questions to Ask Potential Providers About Costs

When selecting a home health agency, asking direct questions about costs is vital. Here are a few important questions to consider:

- What services does the Medicare-approved amount cover?

- What portion of DME costs will I be responsible for?

- Do you accept my Medigap plan, and how will it impact my out-of-pocket expenses?

Understanding these cost factors and asking the right questions ensures you're prepared for potential expenses and can focus on your recovery. Careful planning helps you avoid financial surprises and maximize your Medicare home health benefits.

To help illustrate the breakdown of costs, let's look at a sample scenario.

Medicare Home Health Cost Breakdown

Detailed breakdown of patient costs for different types of Medicare home health services.

| Service Category | Medicare Pays | Patient Responsibility | Conditions |

|---|---|---|---|

| Skilled Nursing | 100% | $0 | Medicare-approved, provided by a certified agency |

| Physical Therapy | 100% | $0 | Medicare-approved, provided by a certified agency |

| Speech Therapy | 100% | $0 | Medicare-approved, provided by a certified agency |

| Hospital Bed (DME) | 80% ($800 example) | 20% ($200 example) | Medicare-approved |

| Wheelchair (DME) | 80% | 20% | Medicare-approved |

This table provides a simplified example. Actual costs can vary. Always confirm with your provider and Medicare for precise coverage details. Being informed about your potential costs empowers you to make the best decisions for your health care needs.

Getting Approved: Your Step-By-Step Qualification Guide

Navigating Medicare's eligibility requirements for home health care can feel daunting. This guide simplifies the four main criteria: homebound status, skilled care needs, physician orders, and Medicare-certified agencies.

Understanding Homebound Status

"Homebound" doesn't confine you completely. It means leaving home requires significant effort and isn't medically recommended due to your condition. Occasional outings for necessities like doctor's appointments or quick errands are generally acceptable. This flexibility recognizes that total isolation can negatively impact well-being.

Demonstrating Your Need for Skilled Care

Medicare requires physician certification confirming your need for skilled care. This includes services like skilled nursing, physical therapy, or speech-language pathology. These services must be medically necessary for treating your illness or injury, meaning they are essential for recovery and can't be effectively provided by unskilled caregivers. Read also: What Is Mobile Wound Care and Why Is It Important?

The Importance of Physician Orders and a Home Health Plan of Care

Your physician's role is crucial. They must develop a home health plan of care outlining the required skilled services, their frequency, and estimated duration. This plan, along with the physician's certification, forms the basis of your application. Thorough documentation of your condition and the need for skilled care strengthens your request.

Choosing a Medicare-Certified Agency

Services must be provided by a Medicare-certified home health agency. Using a non-certified provider can result in denied claims and unforeseen costs. This step is vital.

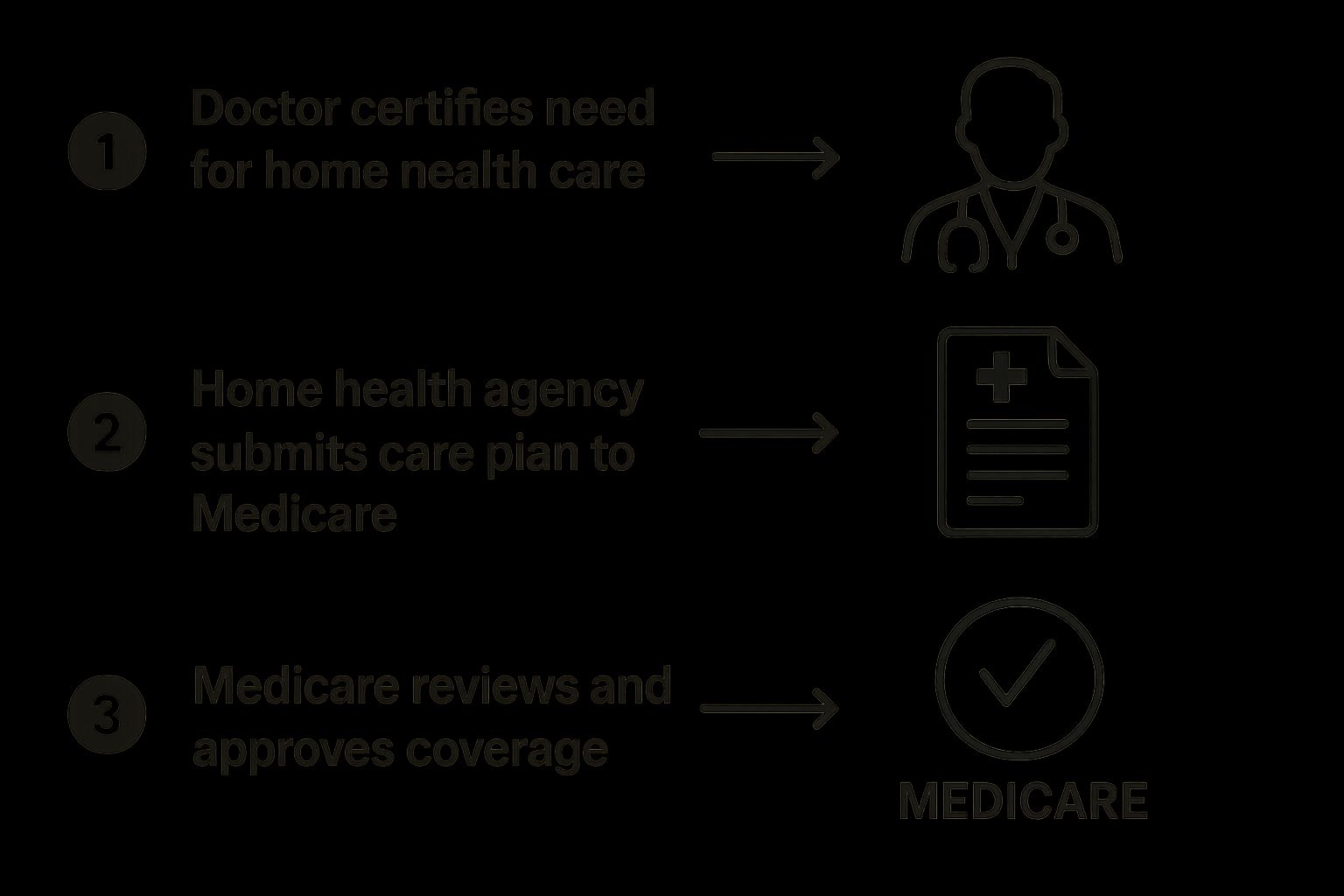

The Approval Process: A Visual Overview

The following infographic summarizes the Medicare home health care approval process:

This simplified process starts with your doctor certifying the need, followed by the agency submitting a care plan, and concludes with Medicare's review and approval. Each step is essential for securing coverage.

Appealing Denied Claims

Even with thorough preparation, claims can sometimes be denied. If your request for Medicare home health coverage is denied, don't be discouraged. You have the right to appeal. Collaborating with your physician and the home health agency to address the denial reasons is crucial for a successful appeal.

Maintaining Your Eligibility

Medicare periodically reviews home health care plans to ensure continued medical necessity. Maintaining open communication with your healthcare team and attending scheduled follow-up appointments are important for ongoing coverage. Plan adjustments might be necessary as your condition evolves. Proactive communication ensures you receive the necessary care throughout your recovery.

Why Finding Home Health Care Has Become So Challenging

Locating Medicare home health care is becoming a real struggle. Even if you meet Medicare's requirements, finding an agency with openings is a growing problem for families. Several factors impacting the home health care industry contribute to this difficulty, creating hurdles for those seeking care at home.

The Impact of Provider Shortages and Agency Closures

The home health care industry is grappling with major staffing shortages. Agencies constantly struggle to find and keep qualified nurses, therapists, and aides. This shortage often leads to limited capacity and extended wait times for patients. Adding to this strain, some home health agencies have closed due to financial difficulties, shrinking the choices for those needing care. This creates a stressful situation for families requiring immediate assistance.

How Industry Upheaval Affects Access to Timely Care

The Medicare home health program has seen a drop in the number of beneficiaries served. Although demand for home-based care is rising, due to an aging population and the desire to age in place, the program served 500,000 fewer patients in recent years than in 2019. One contributing factor is Medicare home health payment cuts, projected to total $20 billion in reductions by 2029. Explore this topic further. These cuts make it tough for agencies to maintain operations and offer adequate services, affecting timely access. Delays in receiving needed care can significantly affect patients' health and well-being.

Geographic Disparities in Access: Urban vs. Rural Challenges

Home health care access varies considerably across the country. Urban areas generally have more agencies, but also greater demand and competition for services. Rural communities, conversely, face limited provider availability, creating access barriers for residents. This disparity underscores the need for solutions that address these geographic imbalances. It’s not just about Medicare eligibility; it's about finding an available provider.

Navigating Agency Reductions or Closures: Ensuring Continuity of Care

Dealing with reduced services or even the closure of a home health agency can be extremely disruptive. Planning for such possibilities is vital. Having a backup plan is essential to ensure continued care. This includes researching other providers, understanding transfer processes, and communicating openly with your health care team. These actions help minimize disruptions and maintain consistent care during transitions. Being proactive is key to ensuring the best possible health outcomes amidst these industry challenges.

Your Action Plan For Securing Medicare Home Health Care

Now that you understand how Medicare home health coverage works, let's create a plan to get you the care you need. This involves several steps, from talking with your doctor to choosing a home health agency.

Initiating the Process: Talking to Your Doctor

First, talk openly with your doctor. Explain your health issues and why you think you need home health care. Focus on how your limitations make daily tasks and medical needs difficult to manage. Your doctor will evaluate your condition and decide if you qualify for homebound status and skilled care.

Preparing for the Home Health Assessment

If your doctor agrees that home health care is appropriate, they will create a home health plan of care. This plan outlines the specific skilled services you need, such as nursing, physical therapy, or speech therapy, and how often you'll receive them. Be ready to discuss your needs during the assessment.

Selecting the Right Medicare-Certified Agency

Choosing a Medicare-certified agency is essential. Medicare won't cover services from agencies that aren't certified. Start researching agencies early. Consider their reputation, experience with your specific needs (like wound care), and availability in your area. Agency availability can fluctuate due to recent industry shifts.

Questions to Ask Potential Providers

When you contact agencies, ask these questions:

- "What specific services do you offer?"

- "Do you have experience with my condition?"

- "What is your average response time for new patients?"

- "How do you handle scheduling and communication?"

Maximizing Your Medicare Benefits and Coordinating Care

Once your care starts, stay organized. Keep records of all appointments, services, and conversations with your healthcare team. This documentation is vital for maintaining coverage and resolving any issues. Also, coordinate with your doctor and the home health agency to track your progress and adjust your care plan as needed.

Long-Term Planning and Adapting to Evolving Needs

Your health needs may change. Regularly review your home health care plan with your doctor. Discuss any new issues or improvements. This ongoing evaluation helps ensure you're always receiving the right level of care. Understanding your options and planning ahead empowers you to manage your health effectively.

For specialized wound care at home, consider Rapid Wound Care. They offer comprehensive treatment for various wound conditions, including chronic wounds and diabetic ulcers, and accept Medicare Part B insurance. Learn more about their personalized care and response times on their website.